Over the past decade, we have loudly beaten the drum for considering corporate social responsibility (CSR) of suppliers in a holistic IT sourcing strategy. We’ve prominently identified CSR scores in our supplier rankings, along with industry-specific variables like power efficiencies of data centers. We’ve enjoined CTOs and CIOs to pay heed to the PR nightmares of companies affected by CSR failures in their manufacturing supply chains, noting that polluting cloud partners are nearly as ripe a target for activists as sweatshops and worker suicide in 996 work environments.

And through all of this, the collective industry response has largely been “meh.” Or in more detail, “CSR is a nice to have, but I’m getting evaluated on cost, risk, and performance.” As a result, only a small fraction of visionary IT leaders would lend more than 3%-5% of their evaluation weights to CSR metrics, and even then, emphasize those that also correlate to other success factors – for example, renewable hydropower that also happens to sell for less than 5 cents per kilowatt-hour. But things are changing.

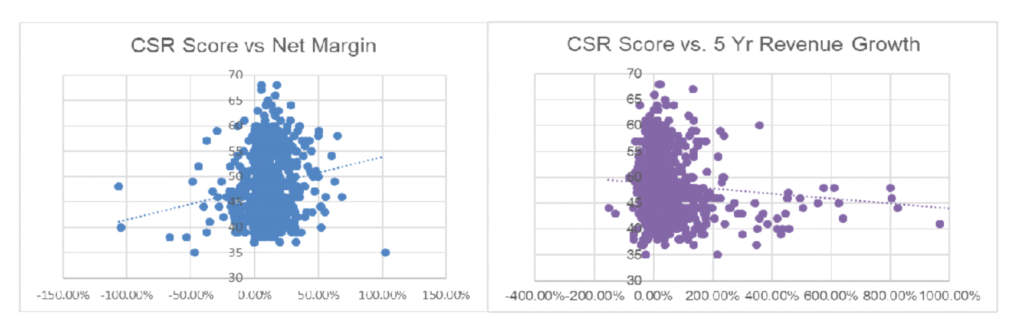

To bring more visibility to this important topic, we thought we’d examine how CSR scores correlate to important metrics of growth and profitability. We’ve previously participated in research projects that demonstrated that technology innovation is closely tied to outperforming your competitors. But does social responsibility also follow suit?

After examining results from 1038 companies with more than $1B in revenues and current CSR scores computed by CSRHub, the results appear mixed. There are a 15% positive correlation between profitability and CSR scores – so more profitable companies also invest more in social responsibility. But there’s also a negative 13% correlation between growth and CSR, meaning that companies that are doubling in size every year are less likely to check all the boxes necessary for good citizens as they move fast and break things.

The results are by no means overwhelming. A 13%-15% correlation is far from destiny, and plenty of companies are not following the trend as evidenced in the graphs above. Furthermore, the correlation does not extend to smaller companies, many of whom suffer from incomplete reporting. And most importantly, defining a correlation should not be automatically inferred to a causal relationship. In fact, three plausible explanations are possible for the first finding of higher profit margins linking to high CSR scores:

- Rich companies are able to afford luxuries like an investment in the environment and their workers, meaning that net income drives CSR

- Socially responsible companies are recognized by their customers for their actions and are able to charge higher margins

- The same factors – for example, strong visionary executives or participation in certain industry sectors – lead to both profitability and investment in CSR.

Untangling the causal arrow will require additional research into trend data both on the CSR ratings and financial results to see if a socially responsible investment is a leading indicator of future financial health (and therefore a factor in making a company profitable) or a trailing one, reflecting the largess of success. But it is encouraging to note that there is a link between the two, and we are hopeful that this will lead to the increased prominence of CSR in enterprise IT decision making.