Shared Services Benchmark – Media

Synopsis: A top movie studio approached RampRate to examine its current relationship with its corporate parent’s internal services organization. RampRate identified significant financial deficiencies that could be resolved by pursuing an outsourced model; however, the services were kept in-house for strategic reasons. RampRate significantly revised the SLA to ensure that the high costs were offset by strong service level commitments.

Result: It was found reductions of 26% would be realized through mid-contract negotiation, while increasing services levels 64%. The corporate division used this data to reduce their division operating bill from shared services over $13mm/year.

Competitive Analysis and Financial Flow Research for Media Delivery

Synopsis: Building on the “Value Chain Research” delivered (see below), the media and entertainment service engaged RampRate to perform a thorough analysis of seven major competitors. This research also analyzed the financial flows of the content delivery value chain for three content revenue models: pay-peruse/ view, subscriptions, and “free” content financed by corporate marketing and advertising budgets (or other spending by parties other than content consumers).

Results: The client was able to prioritize segments and opportunity within the key value chain elements to (a) have the greatest impact on overall profitability and (b) owned or influenced value chain operations and evolution. The client used the competitor analysis to reevaluate its competitive strategies.

Value Chain Research on Content Delivery and Online Media Services

Synopsis: A media and entertainment service engaged RampRate to define, size, and analyze the content delivery value chain for online media services. RampRate analysis provided guidance on o Processes involved of the content delivery value chain for consumer-oriented content, to the PC, the television, and mobile devices

* Market sizing of the “service operations” segment of the value chain, i.e.,

* the processes involved in delivering content over IP-networks.

* Identification of the leading suppliers operating in the value chain segments.

* Analysis of the technical and business pain points in the market

Results: The client was able to understand where its services fit into the value chain, as well as the potential opportunity within the various segments. This project let the financial flow and competitor analysis (see above).

Desktop Support Outsourcing – Publishing

Synopsis: A leading book publisher engaged RampRate to advise and manage the RFP process for its global desktop outsourcing initiative. RampRate created the RFP document, supplied financial targets, and managed the due diligence process; drastically accelerating evaluation time. The client chose to not follow RampRate’s recommendations due to a strategic relationship with one of the target vendors; however, this decision led to ongoing issues during the implementation phase.

Result: Cut 24$ of 7-31% of OPEX through mid-contract negotiation, while increasing service levels 14%. The project was completed within 6 weeks of kickoff.

Mid-Contract Negotiation – Retail

Synopsis: A top 5 online retailer used RampRate services to adjust several of its key supplier relationships for content delivery network and data center services. This included negotiation of major discounts ($16mm-figure savings expected over 2 years), a ramp-down for services being transitioned elsewhere, and inclusion of all existing divisions / subsidiaries / business units under a shared umbrella contract and pricing model.

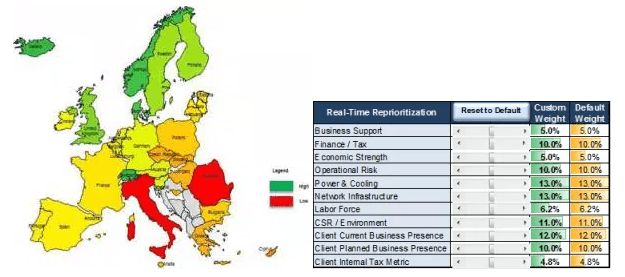

Site Selection – Retail

Synopsis: A top 10 online retailer is using RampRate market intelligence to consolidate the EU and Asia Pacific data centers of its many domestic and international divisions / subsidiaries into 2 primary hubs per region. To enable this process, RampRate built a site selection tool that incorporates 70+ key financial, demographic, availability, and service reliability criteria into a scorecard with inputs from all relevant decision makers. It also built custom country-specific profiles for locations that were considered to be “finalists.”

Internal Shared Services Benchmark Series – High Tech

Synopsis: A Fortune 20 software supplier engaged RampRate 14 times over the course of 4 years to perform an in-depth benchmark and sourcing analysis of services it was buying centrally on behalf of dozens of individual business units. This review includes a thorough analysis of the costs, service levels, and contract terms for data center operations, managed services, back-up services, networking & connectivity, and Internet bandwidth utilization.

Initially, the client used RampRate’s analysis to compare its shared services operational costs and service levels against the market and demonstrate the value of joint buying to recalcitrant divisions. RampRate’s presentations were used for recruiting / retention of all internal divisions through dozens of one on one meetings conducted by client with its divisional heads. The client also restructured its internal chargeback model to better reflect underlying cost inputs and reduce undesirable behavior from internal customers. Subsequent refreshes added more in-depth comparisons against specific technology providers that were approaching the client’s business units directly. They also focused in depth on specific service design elements such as:

- Right-sizing service levels for specific business unit needs

- Centralization of value-added services (e.g. account managers)

- Building an internal SLA for sourcing timelines

- Improving forecasting incentives

External Provider Sourcing Series – High Tech Synopsis

The Strategic Sourcing Group of a Fortune 50 integrator engaged RampRate 7 times over the course of 3 years to perform tactical benchmarks and assist with sourcing on behalf of its data center and network purchasing teams.

These projects ranged from quantifying market rates for planning/budgeting purposes, to gap analysis on services currently purchased, to rapid identification of target suppliers/offers for new expansions, to projections of underlying supplier cost drivers. Benchmarks were conducted on a global basis, with a scope ranging from 7 countries / metros to 20+ concurrent benchmarks. We architected a savings of $26mm.

Specific deliverables included

- 20-metro benchmark of data center space and power costs, including availability analysis and supplier prioritization

- Gap analysis of 499 existing contract documents to identify oversights in legal terms / SLAs as well as out-of-market rates

- 10-metro benchmark of data center space/power as well as network connectivity costs and availability

- 7-metro cost projection for a specific global initiative rollout budget

- White paper to socialize revisions in cost modeling for data center

- 19-country sourcing guide, including in-depth profiles of service availability, taxes, regulatory, and other considerations

- EU site selection matrix, prioritizing top countries for consolidation of regional data centers

- Solicitation of supplier quotes in Europe, South Africa, and several Latin America locations

- 24-metro subscription benchmark with regular refresh

Read what our Clients say about us.

All are available for references.

RampRate provides real-world data intelligence that delivers a precise sense of actual market prices and a better understanding of services providers.

Global Payments – Digital Entertainment

Scope: Strategic research of global digital entertainment market

Geography: Global

Synopsis: A global leader in electronic payments processing and credit/debit issuance required a global market study of all forms of digital entertainment media, to evaluate a new product and to simplify global purchases of digital entertainment and media.

Approach and Solution: RampRate conducted a thorough evaluation of the current and future state of the digital entertainment and media marketplace and developed a complete digital media value chain to anticipate the future state of all economic drivers supporting the current and future marketplace. Additionally, RampRate conducted one-on-one interviews with executive-level industry experts to gauge their industry expertise to substantiate the primary research developed.

Result: RampRate completed its market research in record time and under budget. Throughout the process, RampRate was able to update the client daily with reviews helping them formulate their business model and planning on the fly. The result of the RampRate market research study helped the client prioritize its global top-10 projects prior to their IPO.

Games Developer – Global Payment Processing

Scope: Electronic payments sourcing

Geography: Global

Synopsis: A leading video games developer in the United States endeavored to transform their popular console games into online MMO-style versions complete with subscription-based electronic payments. This endeavor required a multi-national effort to locate and evaluate payment processing IT Suppliers for potential consideration.

Approach and Solution: RampRate conducted an exhaustive study of 75+ electronic payments providers globally; evaluating them on over 100 different criteria required by our client. By developing a common evaluation criteria methodology, the participating IT Suppliers were evaluated side-by-side and considered for final participation in the selection process.

Result: Within two weeks, the field was quickly narrowed from the 45+ qualified vendors to 6 suppliers, based on criteria supplied by RampRate’s client. Three IT Suppliers were ultimately selected based on their various strengths, product offerings and geographic positioning.

Insurance Carrier Disaster Recovery Services

Scope: Sourcing Review / Selection

Geography: North America

Synopsis: A leading international insurance services provider, consisting of over 5,000 companies and servicing clients in over 1150 countries, suffered from excessive cost over runs from their existing disaster recovery services provider. The firm instigated a significant cost-cutting and restructuring program with a greater focus on improving the quality of service they currently received while reducing the overall costs and integrating disparate facilities into one, regionally accessible location with the ability to hot site facilities to different time zones with preferential priority. This program included both sourcing and IT Supplier selection functions through a proprietary evaluation and selection process.

Approach and Solution: RampRate met with the client to determine their exact needs and requirements and evaluated the current IT Supplier’s former and proposed contract. RampRate then formulated an evaluation matrix to organize and compare every aspect of the previous service agreement to the proposed agreement, providing for a clear comparison between the service offerings, terms, conditions and pricing. RampRate then engaged two additional tier-one disaster recovery IT Suppliers and evaluated their proposed offerings side by side.

Result: By way of RampRate’s side-by-side proposal evaluation methodology, the insurance company ultimately concluded how disproportionate the various service offerings each IT Supplier supplied. RampRate successfully negotiated better terms, conditions and rates from all three IT Suppliers and negotiated over $9M in annual savings from the IT Supplier ultimately selected.

Social Video Media Network

Scope: Technology / process consulting

Geography: North America

Synopsis: A leading social media network was experiencing difficulties managing explosive growth in subscriptions which caused numerous system failures and outages resulting in lost subscribers. As a result, the company lost opportunities to acquire new subscribers as well as considerable sums of money from advertising and promotion activities.

Approach and Solution: RampRate conducted a thorough assessment of the company’s operational state including all technology infrastructure, personnel, policy, processes and procedures. RampRate identified numerous deficiencies and developed a step-by-step process to remedy the systemic failures plaguing the company and its user base.

Result: Within 30 days of the implementation of RampRate’s proposed corrective actions, the company stabilized its platform and met its target of 1,000,000 subscribers 6 months ahead of schedule.

Distributed Computing Benchmark – Financial Services

Synopsis: A Fortune 50 financial services provider used RampRate’s services to provide a point-in-time financial comparison against its internal costs in 7 key data centers, as well as on-demand storage utilities and server management. In conjunction with this activity, RampRate analyzed CPU utilization metrics to assess the efficacy of the client’s distributed computing operations. As a result of the project, the client focused its efforts on improved measurement of utilization beyond CPU to include I/O and storage while validating the fact that its data center operations were competitive with market medians for the region.

Result: We cut 26%% mid-contract negotiation, while increasing services levels 74% and saved the $13mm.

DC Operations Benchmark – Financial Services

Synopsis: A Fortune 50 financial services provider engaged RampRate to perform an in-depth benchmark of its in-house data center services, using RampRate’s SPY Index™ to identify areas of potential savings. The benchmark revealed that contrary to initial assumptions, labor was one of the lowest-cost items compared to market and peers, while data center space was the least cost-effective. As a result of the benchmark, the client established a deep, repeatable process for measuring data center operational efficiency and a reporting structure to use for management updates.

Result: We cut 19% through mid-contract negotiation/outsourcing, while increasing services levels 42%.

Shared Services Benchmark – High Tech

Synopsis: A Fortune 50 software IT Supplier engaged RampRate to perform an in-depth benchmark and sourcing analysis of its 358 external providers of IT services, using RampRate’s SPY Index™. This review included a thorough analysis of the costs, service levels, and contract terms for data center operations, managed services, back-up services, networking & connectivity, and Internet bandwidth utilization.

It also examined, for key vendors, the suite of services offered, bundling of services offered, standard and best-in-class service levels, list price for individual services and bundled service packages, average actual prices for individual services and bundled service packages, and operational costs for services provided. The client used RampRate’s analysis to compare its internal operational costs and service levels against the market. It also restructured its internal chargeback model to reduce undesirable behavior from internal customers.

Result: We cut costs 34% that were realized through mid-contract negotiation, while increasing services levels 21%.

IT Operations and Sourcing

Infrastructure Planning for Startup Synopsis: Several months before the launch of its service, a start-up radio station with an innovative business model approached RampRate to procure content delivery services. RampRate assessed a variety of potential cost models, including revenue-sharing and other unconventional arrangements before identifying the optimal model for meeting the client’s budget without compromising long-run scalability or profit.

Results: RampRate’s research allowed the client to meet its target expense rates by reshaping the charge model used by prospective CDN suppliers. It is currently engaged in a follow-on process to identify a media management and analytics platform for the same client.

Strategy Planning for Service Provider Industry Association

Synopsis: The leadership of a global Internet service provider industry association engaged RampRate to validate and extend an early draft of its program strategy. RampRate performed one-on-one interviews with 25 member organizations, testing the feasibility of proposed organizational and strategy changes as well as collecting tactical input for fulfilling the association’s missions.

Results: The industry association postponed a major change in membership structure. RampRate’s analysis also helped the organization streamline its communication methods and identify roadblocks to effectiveness of best practices working groups.

Opportunity Assessment of Tier 2 and Tier 3 Telecom Markets

Synopsis: A major media platform supplier engaged RampRate to analyze potential opportunities in Tier 2 and Tier 3 telecom market segments for the platform. RampRate also summarized opportunities in seven adjacent market segments, such as multi-dwelling units (MDUs).

Results: The client used RampRate’s research to inform its channel strategy for Tier 2 and Tier 3 telecom suppliers. It also used study results to understand specific holes and scoped the market opportunity within Tier 2/3 markets.

Wireless Communications

Value Chain Research on Mobile: Application Developers and ISVs

Synopsis: An enterprise software company engaged RampRate to research the mobile application developer and ISV ecosystem for non-voice applications to cell phones and handheld devices. Using primary research with mobile application and content developers, application distributors, and wireless carriers, RampRate defined the business models, business scenarios, and financial flows of the mobile application market. RampRate analyzed the role of RampRate profiled developer expectations and preferences on current program design, timing, and business models.

Results: Based on RampRate’s research, the client developed a roadmap for extending its enterprise software to cell phones and handheld devices, and created a branch of its developer program targeted at mobile ISVs and developers.

Opportunity Ana-lysis for Mobile Media Software Platform

Synopsis: A major mobile media software supplier engaged RampRate to rapidly determine the market opportunity for a new platform offering for mobile operators, to appraise the competitive landscape, and to evaluate its partnership/acquisition strategy. RampRate evaluated mobile media offerings of 92 operators representing 89% of global subscribers and 130 industry players, with in-depth analysis of 79 competitors/partners in six segments. In addition to strategic advice, RampRate delivered an extensible market analysis tool for building growth scenarios and identifying new partners.

Results: RampRate validated the feasibility and revenue potential of the business plan. Based on RampRate’s analysis of low revenue potential in its initial targets, the ISV re-evaluated its market entry tactics. RampRate’s detailed forecast model and competitor analysis tool were used to recast the business plan under a variety of scenarios.

Affinity Market Research for Potential MVNO Offering

Synopsis: A major entertainment content company engaged RampRate and a research partner to evaluate potential branding and affinity partners for a new MVNO offering. RampRate performed detailed research into 15 potential markets, to determine market size/opportunity, technical maturity, demographics, average spend rate, etc.

Results: The client began immediate pursuit of 2 MVNO markets with specific partners identified by RampRate and its research partner. Four other markets were slated for further research after the current budgeting cycle was complete.

The Role of the PC in the Wireless Ecosystem

Synopsis: An enterprise software supplier engaged RampRate to develop the research and framework for a go-to-market product plan for a software package designed to: * Enable communication between the PC and wireless devices * Interoperate with the media formats * Enable wireless device manufacturers and carriers to (a) realize the client as an invaluable partner, (b) increase revenue opportunities, and (c) enhance relationship with the customer.

Results: RampRate’s analysis of over-the-Air (OTA) revenues for operators and the potential impact of the PC enabled the client to develop a product plan to (a) enhance communication between wireless devices and the client’s software, (b) create solutions that will extend the reach of both wireless carriers and device manufacturers, and (c) create business case solutions detailing why carriers and device manufacturers should adopt client software to enhance inter-device communication.

Digital Media Planning and Market Research

Content Delivery/CDNs Large File Content Delivery in the UK

Synopsis: A major media organization headquartered in the UK engaged RampRate to assess its current content delivery arrangements and create a strategic 12-24 month content delivery plan including both traditional (e.g. CDN) and alternative (e.g. P2P) delivery methodologies.

Results: RampRate created a financial assessment of the client’s projected cost and a benchmark against prevailing market rates to help establish a proper budget for the new services being launched in the next fiscal year.

Content Delivery Costs: Micro and Macro Views

Synopsis: Within one week, RampRate delivered exceptionally well-received presentations at two major streaming-related events. In the first presentation, RampRate used the SPY Index™ data from more than 90 recent supplier quotes to assess the evolution of content delivery costs across charging models and commit rates, providing the public with unprecedented transparency with regard to current market rates. In the second, RampRate used its research base to put CDN and other delivery costs in the context of the 7 top digital media business models to date, leading a panel of experts in a discussion of how delivery costs will impact the big picture in media.

Results: RampRate’s work was met with universal approval and has gained the company, several new clients. Presentations from these conferences are available on request as research samples.

Pricing and Preferences for CDN Market

Synopsis: RampRate undertook a self-funded research project, interviewing 44 buyers of CDN services about their preferences, perceptions, and pricing. The goal of the study was to gather customer input for the Service Provider Intelligence Index-SPY INDEX-and compare customer prices and requirements to supplier list prices and product lines.

Results: RampRate published an industry-leading Executive Brief on the study findings, “Sourcing CDN Services,” with guidance to buyers on market dynamics, supplier capabilities, and current pricing levels. The Executive Brief is available at no cost. Contact RampRate Sourcing Advisors for your copy.

Operations

RampRate has developed a comprehensive guide to operational practices for global hosting providers.

Whether building a new service from scratch, auditing efficiency/profitability, or finding ways to address customer requests, this product will be invaluable in guiding you to insights on the following questions:

- Am I building the optimal service bundles to maximize profit and customer uptake

- How should I track and report on SLAs to my customers?

- What are the best practices for capacity planning?

- What customers deserve a dedicated account manager, a named contact, or just a phone number to the call center?

- How do best-in-class providers price and configure their services by type, customer size, and strategic relationship?

RampRate can examine your service levels and compares them to competitive offerings and what customers are demanding. And what customers care little about. RampRate prices this product as a simple flat fee based on the service categories you need to review. Imagine having an unbiased market opinion on key SLA metrics like:

- Percentage of target terms accepted Average annual downtime Exclusions to SLAs

- Service Credits

- Power Density

- Redundancy

- Uptime Guarantees

- Temperature Guarantees

- Server Response/Resolution

How do we know the market?

Our SPY Index™ provides near real-time intelligence on more than 500 vendors, in 100 countries and 300 metro regions, for over a dozen different IT service types. For more than a decade, we’ve been counseling IT buyers on their vendor selection process. Now, we are helping the vendors use this same, powerful data to reposition and compete effectively. Use this important market data to decide what you should put in your basic, average, and premium bundles.

As part of this custom research project, we’ll provide you with in-depth guides to customization, bundling, tiering, account management, and other key factors to sharpen your product offerings. We’ll also include examples of how top providers are structuring their competitive offerings. Do you know where you cut costs without affecting customer value?

How Do I Use SPY Index™ to Support Strategic Decisions?

RampRate’s unique combination of sourcing, consulting, and research services allows us to see emerging trends in the market on a granular level, often times before typical market analysts can draw meaningful conclusions. Our street-level, in-the-field work provides us with deep visibility into business models and trends much earlier than the market at large can see them.

Each Research Service engagement leverages the continually updated SPY Index™ to provide accurate market data on the supply side — including supplier offerings, historical performance, and customer satisfaction — as well as the demand side — reflecting user needs, priorities, and willingness to pay for IT services. Our hard data is combined with focused, in-depth primary research in developing concrete recommendations for market buyers and vendors across vertical markets.

Ramprate Customer Success: Types of Research Services

Strategic Research

RampRate’s industry-leading research staff uses our SPY Index™ and other primary research data resources to build business plans, create new architecture models, and evaluate market alternatives for your internal planning. We can easily assess the financial and operational impact on your business so you can make the right decision for your company.

Customer Voice Studies

One-on-one, in-depth interviews and the SPY Index™ enable our analysts to determine the priorities, drivers, trigger points, and adoption hurdles affecting core and target customers.

Growth Strategy Studies

RampRate will work with you to determine the optimum stage in the adoption cycle for your target markets and recommend specific actions to accelerate the adoption of your products and services.

Customer Metrics Studies

Using SPY Index™ spending data and in-depth customer interviews, we can investigate the core metrics that customers use to evaluate and justify their IT investments during and after sourcing decisions.

Go-To-Market Sizing and Analysis Studies

RampRate has extensive experience with developing interactive market sizing tools for of nascent, emerging, and mature segments using SPY Index™ data on current usage and IT spending. RampRate combines SPY Index™ data with custom primary research to identify the specific implications of the client’s go-to-market strategy.