How Do I Use SPY Index™ to Support Strategic Decisions?

RampRate’s unique combination of sourcing, consulting, and research services allow us to see emerging trends in the market on a granular level, oftentimes before typical market analysts can draw meaningful conclusions. Our street-level, in-the-field work provides us with deep visibility into business models and trends much earlier than the market at large can see them.

Best Practices Research on Subscription Video on Demand

Synopsis: A media and entertainment content company engaged RampRate to research the guidelines and architecture requirements for building a greenfield VOD datacenter capable of delivering approximately 4,000 hours of programming at digital cable quality to a North American audience. The research analyzed the baseline for hardware, software, encoding, storage, distribution, and delivery requirements for the initial deployment scenario and the comparative build-versus-buy costs of video distribution models (e.g., download, streaming, data casting).

Results: Based on RampRate’s research, the client built a business plan that included timelines, investment requirements, and essential content and technology partnerships for a new VOD service offering.

Feature Prioritization Research for Media Services Offering

Synopsis: A major media platform provider engaged RampRate to develop a prioritized feature list for an upcoming server release. RampRate performed one-on-one interviews with 50 current customers and partners on their uses and preferences. RampRate performed a follow-on a survey with 35 study participants to clarify feature differentiation.

Results: The client formulated their feature roadmap based on the research findings. RampRate recommended key features for top consideration by the client and provided a weighted priority list for other features. RampRate also provided analysis of current and near-term customer concerns with the client, uses of digital media, codec references, and other related issues that emerged during the research.

Strategy Evaluation of Media in the Enterprise

Synopsis: During the fiscal year budgeting cycle, a major media platform provider engaged RampRate to perform rapid primary research with 30 heavy users of digital media in the enterprise to inform resource allocations and budget priorities. RampRate’s research reviewed the current enterprise strategy, interviewed key channel partners and customers regarding this strategy, and analyzed existing survey and research data.

Results: The client reprioritized the enterprise market to a limited extent, with particular emphasis on three product segments that were lacking in the previous roadmap.

Content Delivery/CDNs Large File Content Delivery in the UK

Synopsis: A major media organization headquartered in the UK engaged RampRate to assess its current content delivery arrangements and create a strategic 12-24-month content delivery plan including both traditional (e.g., CDN) and alternative (e.g., P2P) delivery methodologies.

Results: RampRate created a financial assessment of the client’s projected cost and a benchmark against prevailing market rates to help establish a proper budget for the new services being launched in the next fiscal year.

Content Delivery Costs: Micro and Macro Views

Synopsis: Within one week, RampRate delivered exceptionally well-received presentations at two major streaming-related events. In the first presentation, RampRate used the SPY Index™ data from more than 90 recent supplier quotes to assess the evolution of content delivery costs across charging models and commit rates, providing the public with unprecedented transparency with regard to current market rates. In the second, RampRate used its research base to put CDN and other delivery costs in the context of the 7 top digital media business models to date, leading a panel of experts in a discussion of how delivery costs will impact the big picture in media.

Results: RampRate’s work was met with universal approval and has gained the company, several new clients. Presentations from these conferences are available on request as research samples.

Digital Home Strategy Analysis

Synopsis: A leading hardware manufacturer engaged RampRate to create a strategy for accelerating consumer adoption of digital media and its products while enhancing the supplier’s brand identity and profits. RampRate evaluated four levels of market engagement across six types of potential content offerings to determine the trade-offs between the goals specified. RampRate’s extensive report also educated the client’s executives on gross margins and operating margins of the digital media value chain.

Results: RampRate’s analysis focused on the supplier’s annual resource planning meeting to develop a long-range strategy for succeeding in the digital home.

Rich Media Usage Research

Synopsis: A rich media recording supplier engaged RampRate to research gaps and difficulties of enterprises in capturing, preparing, and distributing corporate presentations that include rich media elements (audio and video). RampRate performed in-depth interviews with enterprise media managers to determine the potential value of a rich media recorder and developed a marketing-oriented white paper for the client.

Results: The 6-page white paper is receiving up to 50 downloads per week from the client’s Web site, by current and potential academic, government, and enterprise customers.

Pricing and Preferences for CDN Market

Synopsis: RampRate undertook a self-funded research project, interviewing 44 buyers of CDN services about their preferences, perceptions, and pricing. The goal of the study was to gather customer input for the Service Provider Intelligence Index – SPY Index – and compare customer prices and requirements to supplier list prices and product lines.

Results: RampRate published an industry-leading Executive Brief on the study findings, “Sourcing CDN Services,” with guidance to buyers on market dynamics, supplier capabilities, and current pricing levels. The Executive Brief is available at no cost. Contact RampRate Sourcing Advisors for your copy.

Competitive Analysis and Financial Flow Research for Media Delivery

Synopsis: Building on the “Value Chain Research” delivered (see below), the media and entertainment service engaged RampRate to perform a thorough analysis of seven major competitors. This research also analyzed the financial flows of the content delivery value chain for three content revenue models: pay-per-use/view, subscriptions, and “free” content financed by corporate marketing and advertising budgets (or another spending by parties other than content consumers).

Results: The client was able to prioritize segments and opportunity within the key value chain elements to (a) have the greatest impact on overall profitability and (b) owned or influenced value chain operations and evolution. The client used the competitor analysis to reevaluate its competitive strategies.

Value Chain Research on Content Delivery and Online Media Services

Synopsis: A media and entertainment service engaged RampRate to define, size, and analyze the content delivery value chain for online media services. RampRate analysis provided guidance on the processes involved in the content delivery value chain for consumer-oriented content, to the PC, the television, and mobile devices.Market sizing of the “service operations” segment of the value chain, i.e., the processes involved in delivering content over IP-networks. Identification of the leading suppliers operating in the value chain segments. Analysis of the technical and business pain points in the market.

Results: The client was able to understand where its services fit into the value chain, as well as the potential opportunity within the various segments. This project let the financial flow and competitor analysis (see above).

"Within two weeks, we will outline the major players, product offerings, market size, and future expectations."

Now you can make informed decisions and gain a speed-to-market advantage over your competitors. Let RampRate get you up to speed immediately with our Market Folio custom research product. Use a custom Market Folio report to gain up-to-date knowledge of niche products and offerings in the IT industry, including these important key facts:

- Who are the key players?

- What are the key components?

- How does it fit within the broader market landscape?

- What are the gatekeepers (industry analysts and trade press) saying?

- What is the size of the market domestically and internationally?

- How has the market evolved and where is it heading?

We’ll deliver to you a concise summary, giving you a thorough understanding and viewpoint of current market conditions. As a result, you will be able to make decisions rapidly, rather than waiting on the typical, lengthy procurement process.

The Role of the PC in the Wireless Ecosystem

Synopsis: An enterprise software supplier engaged RampRate to develop the research and framework for a go-to-market product plan for a software package designed to enable communication between the PC and wireless devices. Interoperate with the media formats. Enable wireless device manufacturers and carriers to (a) realize the client as an invaluable partner, (b) increase revenue opportunities, and (c) enhance the relationship with the customer.

Results: RampRate’s analysis of over-the-air (OTA) revenues for operators and the potential impact of the PC enabled the client to develop a product plan to (a) enhance communication between wireless devices and the client’s software, (b) create solutions that will extend the reach of both wireless carriers and device manufacturers, and (c) create business case solutions detailing why carriers and device manufacturers should adopt client software to enhance inter-device communication.

Take advantage of our experience and extensive database of supplier profiles to create an accurate, up-to-the-minute analysis for your specific business strategy.

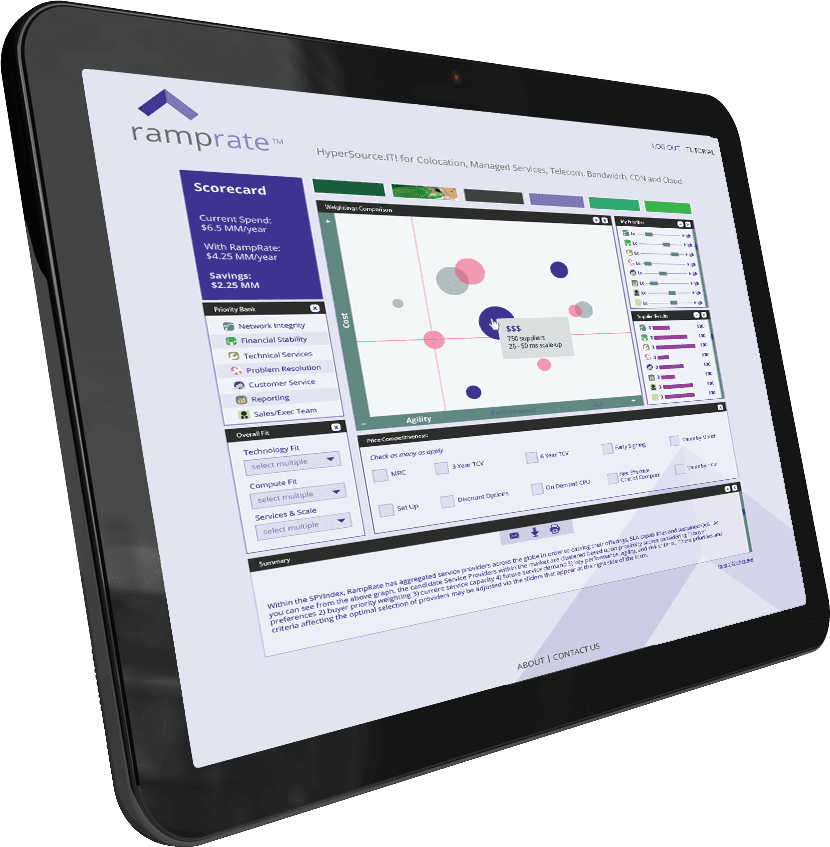

Each Research Service engagement leverages the continually updated SPY Index to provide accurate market data on the supply side — including supplier offerings, historical performance, and customer satisfaction — as well as the demand side — reflecting user needs, priorities, and willingness to pay for IT services. Our hard data is combined with focused, in-depth primary research in developing concrete recommendations for market buyers and suppliers across vertical markets.