UNI token at the core of governance and incentivization – it surges more than 77% reacting to the “biggest week in Uniswap governance ever.” An example of the insatiable market appetite for incentivized governance mechanisms powered by the UNI token.

By: Josh Bykowski | 3/1/2024

In the evolving landscape of blockchain technology, governance and incentivization mechanisms stand as critical pillars that ensure the ecosystem’s resilience and growth. Effective governance models facilitate consensus and decision-making, crucial for network upgrades and conflict resolution. A well-designed web 3 ecosystem, transparent and inclusive, paired with a robust incentivization strategy, attracts participation and investment, driving up token demand and value.

Imagine a world where every click, vote, or transaction you make not only shapes the future of digital democracy but also rewards you for your contribution. Rather than a sharecropping data siphon most internet users are subject to, web 3 users live in a Locke-inspired landscape where ownership is possible and their contributions are economically rewarded. This isn’t just a futuristic vision; it’s the reality of well-governed blockchain ecosystems, where governance goes beyond mere decision-making to become a powerful engine driving community engagement and token vitality.

Consider the recent surge in the UNI governance token following a governance upgrade proposal. The proposal seeks to improve community engagement and activation through a token holder incentive upgrade. Upon the announcement, the UNI token price of this new incentive, $UNI prices soared 77% to reach highs not seen since the 2021 bull run.

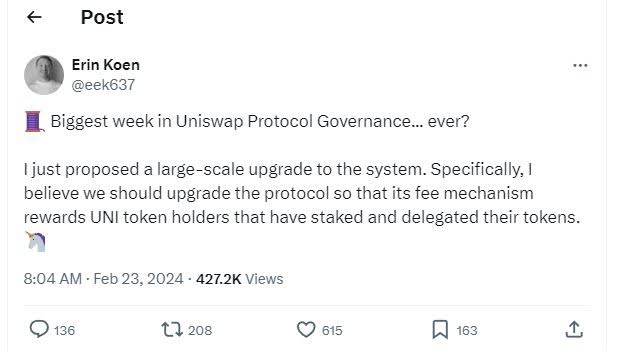

Simply put, the proposal dedicates a segment of its platform fees to perpetually reward $UNI token stakers. This initiative aims to create a continuous flow of growth to devoted holders. Uniswap Foundation’s governance lead, Erin Koen, submitted the proposal and took to twitter to express his thoughts. Koen’s thread on the “biggest week in Uniswap Protocol Governance….ever” included his perspective on how the new incentive will increase both “resilience and decentralization.”

The proposal outlines 2 new contracts, V3FactoryOwner.sol and UniStaker.sol:

- “V3FactoryOwner.sol allows for the programmatic, permissionless collection of protocol fees, and includes a mechanism which incentivizes the conversion of those fees into a common ERC20 for distribution to stakers, who have deposited UNI in Unistaker.sol. In order for this contract to work, it will need to become the owner of the UniswapV3Factory.

- UniStaker.sol manages delegation and fee distribution. Actors responding to the mechanism in V3FactoryOwner.sol deposit an ERC20 into UniStaker.sol to be distributed to stakers. UniStaker.sol is modeled after Synthetix’s battle-tested StakingRewards.sol but extends that contract’s functionality in two key ways: 1) It requires accounts that stake to delegate their tokens, and 2) It enables (but does not require) accounts that stake to assign staking rewards to any other account.”

A deep dive into the technical details can be found in the appendix of the proposal.

Despite the general positive feedback from the Uniswap community and market sentiment, not all are sold on Uniswap’s new incentive mechanisms. For example, one member stressed the necessity of simultaneously introducing incentives for liquidity providers, as there are concerns this proposal threatens their current incentive model. Specifically, because the new proposal suggests capturing a % of value from the transactions facilitated by the liquidity providers, it functions as a “tax” on the transactions the providers enable. Essentially, a portion of the fees that traditionally went to liquidity providers would now be directed to $UNI token stakers. Consequently, this leads to 2 main concerns:

- Incentive for liquidity providers to move elsewhere: less profit for providing liquidity on Uniswap may lead to a transition to alternative DeFi protocols that offer better incentives.

- Conflicting incentives between crucial stakeholders: friction between liquidity providers and $UNI token stakers as one tries to maximize returns, while the other seeks to benefit from fees.

The proposed change is not without trade-offs. It provides another example in decentralized governance where turning one lever on, consequently turns another off.

The governance vote is currently live on snapshot. The outcome of this proposal and its subsequent effect, will certainly be viewed by other ecosystems looking to change their governance and realign their incentives. Regardless of outcome, $UNI’s price spike seems to provide evidence of market demand for incentive realignment, and governance upgrades. As more decentralized systems deal with problems of misalignment, attrition, and corruption, more creative governance incentives must arise as ecosystems face higher scrutiny from both individuals and institutions.

Josh Bykowski is a lawyer and corporate development consultant with a background in history and economics. With a specialization in emerging technologies, he frequently assists blockchain based projects on a consulting basis to achieve both short-term and long-term goals. Josh currently works at RampRate, an advisory firm with a focus on emerging technologies and impact initiatives. His work on emerging tech has been featured in Columbia Law School’s blog on corporations and capital markets.

Reach out to Josh here:

Linkedin: Josh Bykowski

Email: josh@ramprate.com

This blog post is for informational purposes only and should not be taken as professional investment or legal advice. We recommend consulting with qualified professionals for specific guidance.

- Known for contributions to the Enlightenment specifically that individuals have a natural right to property, which is acquired through their labor and investment.

- Uniswap Governance Proposal accessed 3/1/2024

- Erin Koen Twitter accessed 3/1/2024

- Id

- Uniswap community discussions regarding governance and incentives. Accessed 3/1/2024